Auto Insurance in and around Baytown

Baytown! Are you ready to hit the road with auto insurance from State Farm?

Let's hit the road, wisely

Would you like to create a personalized auto quote?

Here When The Unexpected Arrives

Everyone knows that State Farm has outstanding auto insurance. From sedans to smart cars scooters to motorcycles, we offer a wide variety of coverages.

Baytown! Are you ready to hit the road with auto insurance from State Farm?

Let's hit the road, wisely

Get Auto Coverage You Can Trust

Your vehicle will thank you for making sure you're prepared with State Farm insurance. This can look like medical payments coverage, uninsured motor vehicle coverage and/or liability coverage, and more. That's not all! There are also a variety of savings options including Steer Clear®, Drive Safe & Save™ and an anti-theft discount.

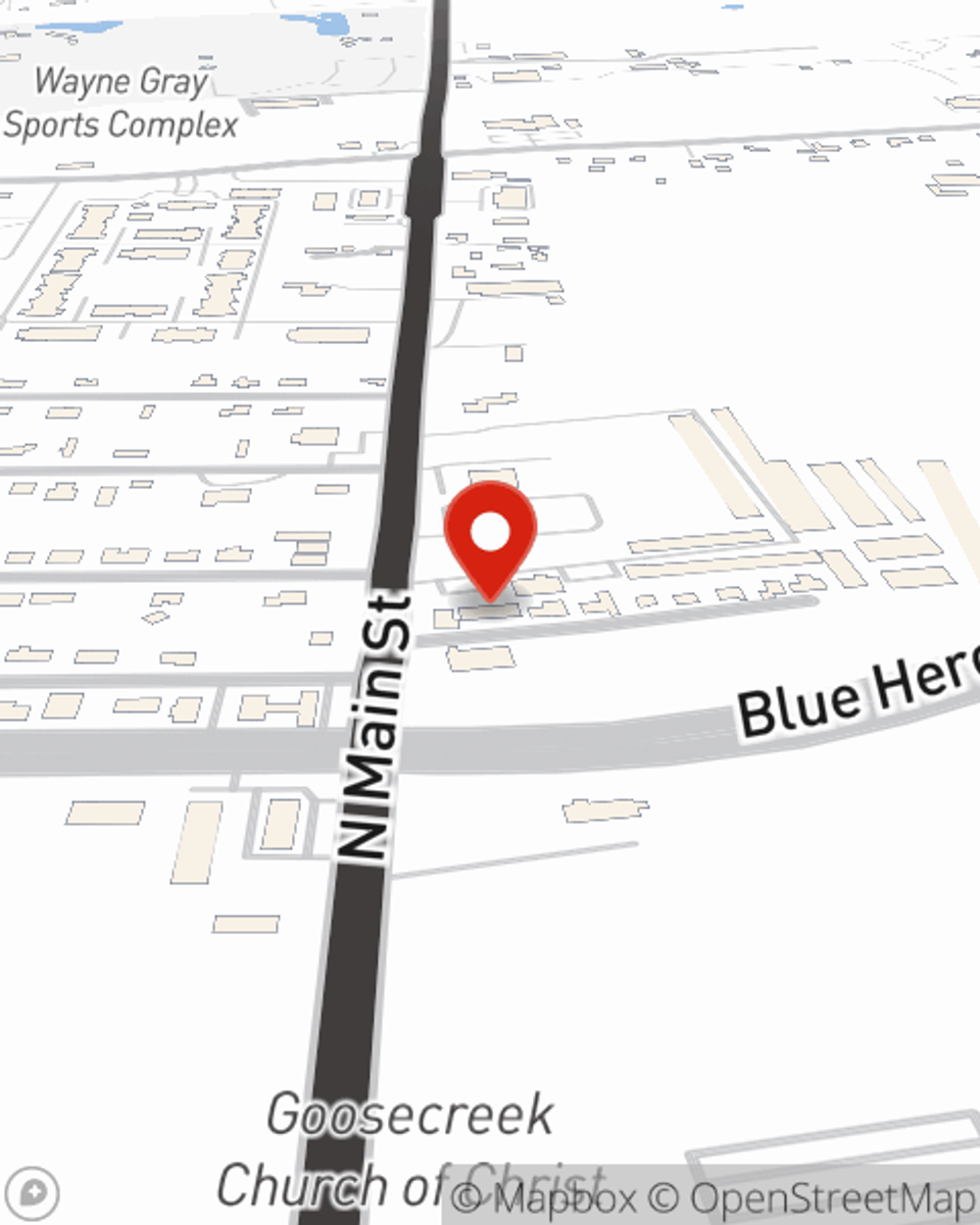

Baytown drivers, are you ready to explore what a company that helps customers by handling thousands of claims each day can do for you? Contact State Farm Agent Randy Casey today.

Have More Questions About Auto Insurance?

Call Randy at (281) 421-2244 or visit our FAQ page.

Simple Insights®

Avoid these risks or you may fall asleep at the wheel

Avoid these risks or you may fall asleep at the wheel

Help prevent drowsy driving by knowing the dangers, identifying warning signs and learning about technology that could prevent accidents caused by driver fatigue.

Information to include on auto insurance applications

Information to include on auto insurance applications

The process of applying for car insurance may seem challenging, but it can become easier when approached with precision and care to avoid mistakes.

Randy Casey

State Farm® Insurance AgentSimple Insights®

Avoid these risks or you may fall asleep at the wheel

Avoid these risks or you may fall asleep at the wheel

Help prevent drowsy driving by knowing the dangers, identifying warning signs and learning about technology that could prevent accidents caused by driver fatigue.

Information to include on auto insurance applications

Information to include on auto insurance applications

The process of applying for car insurance may seem challenging, but it can become easier when approached with precision and care to avoid mistakes.